UX Designer

Get Richer

The Goal: To increase financial literacy in millennials so that they are able to stop living paycheck to paycheck

The Problem:

Millennials need a way to gain knowledge on financial matters so that they are able to get out of debt and achieve financial stability.

The Solution:

Get Richer is creating a game similar to Temple Run that will help inform millennials of financial information. The gamification of information will reach our target audiance, and will be backed by banks.

About

Get Richer was a project developed during Seattle Start Up Weekend. In order to create an experience to improve financial education, we developed a game idea that would subtly provide a stream of information as a player navigated appropriate levels.

Overview

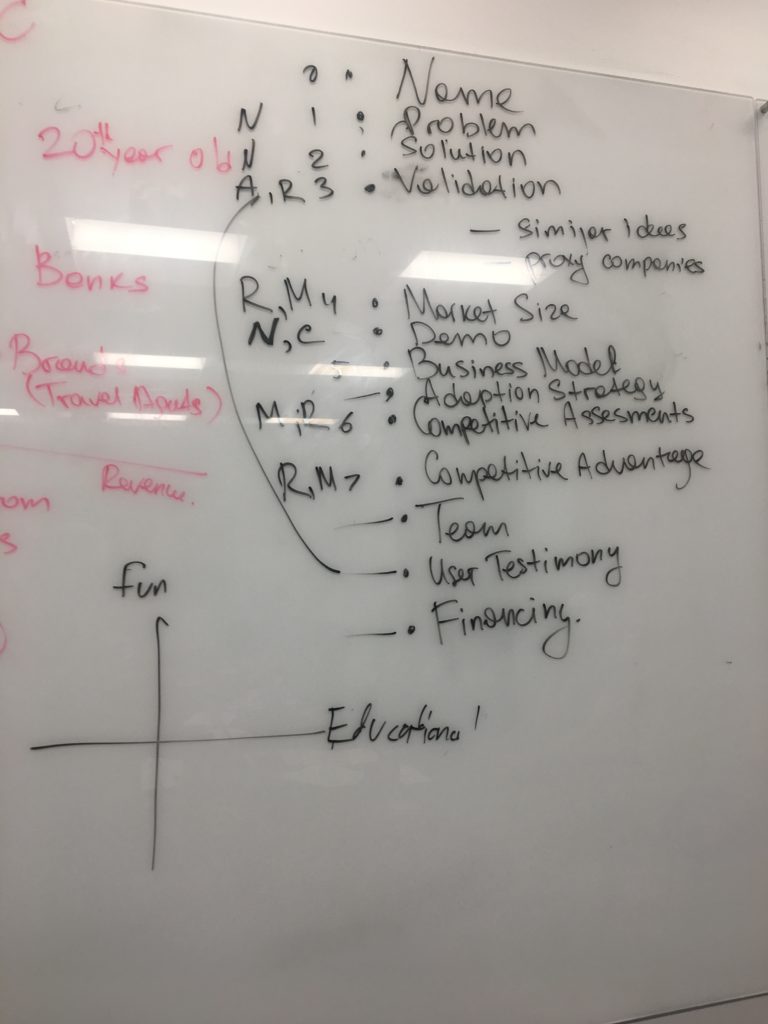

Different than a hackathon, we pitched ideas, voted, and grouped up depending on interest. Team formation ended Friday night, and Sunday evening we presented. Saturday the team brainstormed to find the right problem, and right solution, and that night the original team split into two in order to pursue two avenues to tackle millennial’s financial well-being. I spoke with SMEs, created the designs, and flushed out the details of our project as my team solidified the business case, and created the presentation.

Role

As the sole UX designer, my function through much of the process was to keep the team on track, and make sure we were asking the correct questions. I spoke with possible users, created a persona, and talked to SMEs from multiple fields. I designed the game logo and concept, and helped with the presentation.

Tools

Trello, Sketch, Google Slides, InVision

Results

My team created a business pitch that was backed by user feedback, professional advice, and had been already proved in the market. I made a ton of friends, took part in a huge community event, and experienced a team that went our separate ways during the process, but came back together in the end!

The Process:

Starting with 54 pitches, the night started with a lot of excitement and hope! My main goal of Start Up Weekend was to find a project I could work on that would diversify my portfolio, and add internal forms or tools. I briefly pitched my own project idea, but went to a team whose goal was to improve millenial’s finances in some way. I liked the team, and figured the subject matter would lead to more “serious” work.

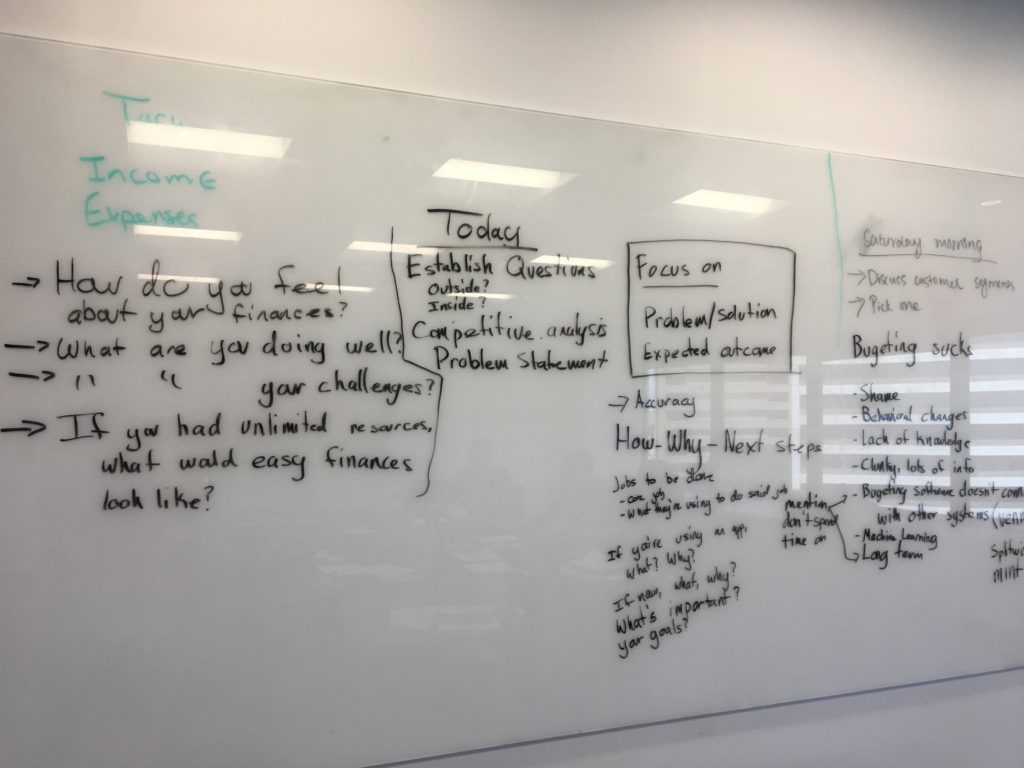

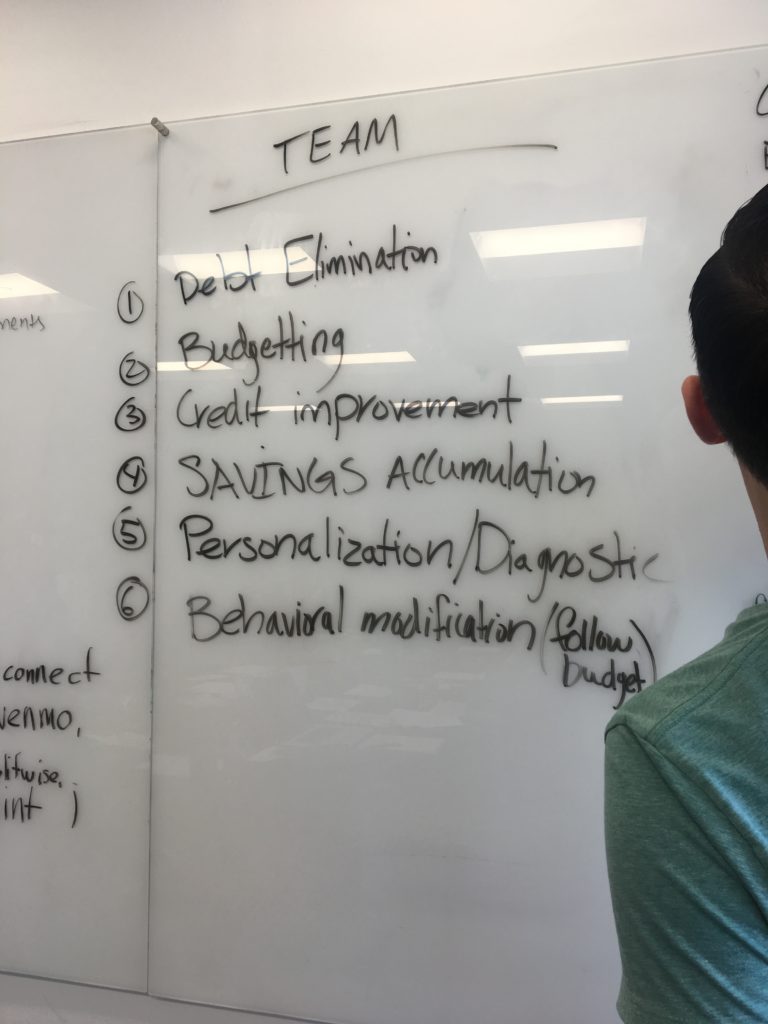

There was a good amount of brainstorming with group, trying to find exactly what the problem we were trying to solve was, for whom, and the best ways to solve it. I brought in tactics I had learned from General Assembly such as the importance of writing things down on a whiteboard, analyzing drivers, asking the five why’s, etc. During this day, I spoke with millennials to see how they felt about their finances, and why they didn’t budget. A lot of users who did not budget said it was boring, too hard, or they didn’t know where to start.

The Pivot:

Here’s where the team split. We went round and round trying to answer the same questions. Who are our users? What problem are we actually trying to solve? How should we split our time? It was exhausting. ourselves into two seperate teams, and we each had an idea on how to tackle the problem. Get Richer split off. Our goal was to create a game that could feed financial information passively, so that our users can get out of the paycheck to paycheck loop. Our plan was to be financed by a banking program called the CRA, which is a program to incentives providing financial literacy for underrepresented communities.

Meet Sandy.

Sandy is 27, and works as a nanny in Seattle. Sandy’s parents were working class, and while she could tell money was tight, it was never a topic of conversation.

She went to college for three years, but didn’t find “what she wants to do when she grows up”, and didn’t finish her degree, but did collect quite a few student loans. With a huge heart, Sandy was drawn to children, and likes her position as a nanny. She needed a car, and purchased a sensible option, but still deals with a sizable car payment. It needed work, so now there’s that debt too.

Sandy pays her bills, and sometimes has money to go out with friends, and other times doesn’t have anything in her checking account. Buying a house is unobtainable, and she can’t afford to take time off to start another career so that she doesn’t worry about money as much.

For Sandy, getting out of debt and not living paycheck to paycheck feels like an impossible journey, and suddenly needing to repair her car removes all the progress she had achieved. What better describes this endless run than Temple Run? A similar game that provided financial information has been successful, called Credit Stacker.

I spoke with SMEs in the form of two game developers who were excited about the idea, and provided insight on possible ways to gamify this sort of information, as well as someone who had worked on a game for students to use when in business school. I talked with financial advisors, and my teammate Rodrick spoke with his connections at the bank to verify this idea.

The Results:

This was an amazing experience, and the whole “Get Rich” family came together after presentations to chat, and get to know each other. The friendships I created were my main take-away, and I learned the work involved with starting a company. I would definitely participate in SUW again!